Write off up to

81% of your debt...

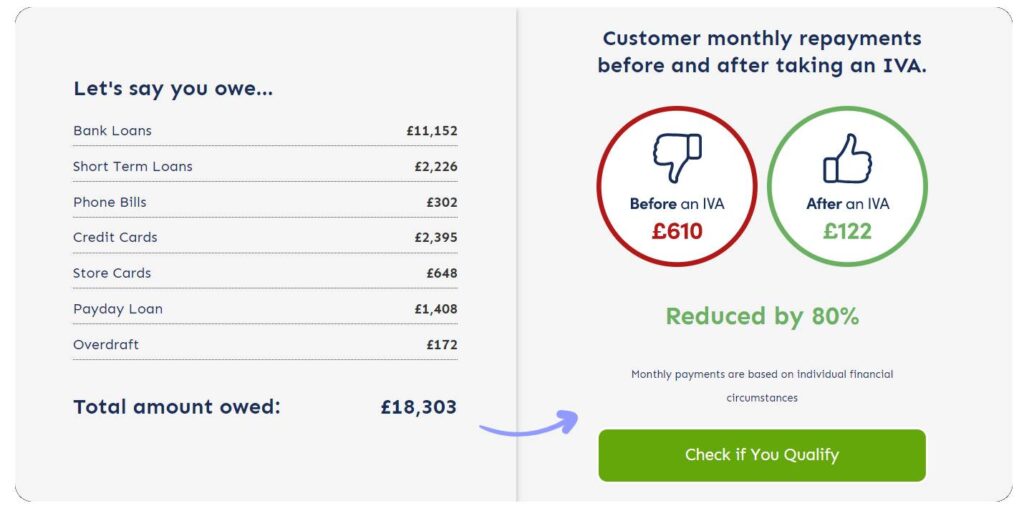

Reduce debts into one affordable monthly payment

Safe, secure & confidential

Stop All Interest & Charges

Write Off Unsecured Debts Over £5,000

Lower monthly repayments

Write off most types of debt, including:

Credit Card

Loans

Lines of Credit

Overdrafts

Store Cards

Business Debt

Add Your Heading Text Here

Our 3 step process...

Step 1

Answer a few quick questions to check if you qualify to write off debt

Step 2

Chat to a debt expert for your personalised plan

Step 3

Leave the rest to us and get back to enjoying life without money worries

Whatever your circumstances, help is available.

Help is available right now

We understand more than most that dealing with debt can be stressful, but we also know how easily it can be resolved. Just get in touch. Do not suffer in silence.

Try our PlanFinder

Do you want to clear your debt? We can help display your options in less than a minute. All you need to do is complete our PlanFinder, there is no obligation and it is completely confidential.

Free debt advice

All advice you will receive from us will be free. You can close an enquiry at the click of a button if you decide against something. If you are serious about change, then get in touch.

We’ll help all the way

We will help with advice, contacting your lenders, with paperwork and even help in the future if you need further advice. We will teach you how to deal with bailiffs and debt collectors too.

Frequently Asked Questions

We offer free debt advice tailored to your circumstances. We’ll find out more about your current financial situation and your lifestyle to advise on the best solution for you. Although we offer advice on all debt help solutions available, we specialise in Individual Voluntary Arrangements (IVAs), Trust Deeds and the Debt Arrangement Scheme (DAS)

All of our initial advice is free; however, fees will apply should you decide to enter into an arrangement. We operate a transparent fixed fee model, which incorporates the Nominee Fee, Supervisory Fee and all costs and expenses associated with the arrangement. Fees will be taken from your monthly payment or asset realisations paid into your arrangement. These will be discussed by an expert advisor to make sure you are fully aware of the costs involved.

DMP (Debt Management Plans)

IVA (Individual Voluntary Arrangement)

Self-Employed IVA

Bankruptcy

You should know that the advice and assistance offered on www.advisor-help.co.uk has not been endorsed by any financial institutions. In addition to being completely free, using our service will not obligate you to go with any of the suggested vendors. Customer service, call recordings and monitoring may be used for quality assurance purposes. As much as 85% of debts will be written off for finding a suitable debt relief option. Your income, assets, and the creditor’s current policy on write-offs will mean all factors into how much of your debt will be written off.

That’s the case, for instance: If you’re interested in an IVA, you’ll need to fill out a questionnaire detailing your income, assets, and necessary expenses, which should include your mortgage payments. Put the remainder of your monthly paycheck into your IVA after you’ve covered your basic living expenses and saved a small amount for discretionary spending. After the five-year IVA period ends, if you still owe money to your creditors, they may agree to write off the rest of your debt. There are alternatives to an IVA that may work better in your situation. Based on your unique situation, the debt advisor will provide recommendations.